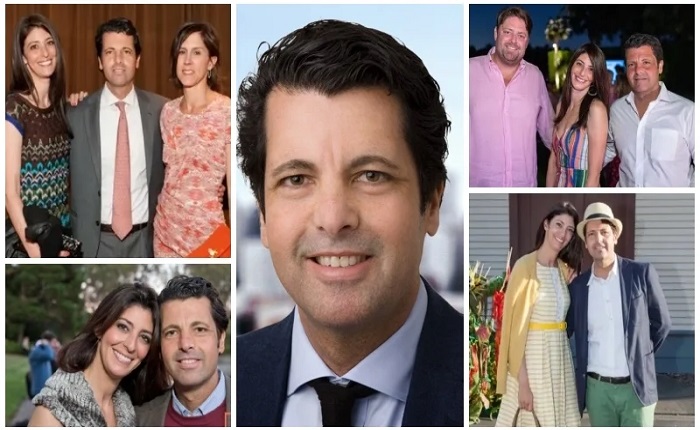

Andre Hakkak: The Visionary Behind White Oak Global Advisors

In the world of finance, few individuals have made as significant an impact as Andre Hakkak. As the co-founder and CEO of White Oak Global Advisors, Hakkak has played a crucial role in transforming the private credit and alternative investment landscape. His vision, strategic leadership, and expertise in financial markets have positioned him as one of the most influential figures in the sector. White Oak Global Advisors, under his guidance, has grown into a highly respected firm with a robust portfolio, providing innovative financing solutions to middle-market businesses.

In this comprehensive blog post, we delve into the life and career of Andre Hakkak, exploring his early beginnings, his contributions to the finance industry, and how White Oak Global Advisors has become a key player in the alternative investment space. Through this exploration, we will gain insights into the philosophy that drives his success and the impact he has had on businesses across various sectors.

Who is Andre Hakkak?

Andre Hakkak is an American entrepreneur, financial expert, and the co-founder of White Oak Global Advisors, a firm that specializes in private debt and alternative investment management. With decades of experience in the finance industry, Hakkak is known for his ability to identify emerging opportunities in the financial markets and craft strategies that benefit both his firm and the clients they serve.

His work has been instrumental in providing financing solutions to middle-market companies, which often struggle to access traditional bank loans. Hakkak’s dedication to innovation and customer-centric solutions has set him apart in a competitive industry.

Andre Hakkak Bio/Wiki

| Attribute | Details |

|---|---|

| Name | Andre Hakkak |

| Birth Date | August 29, 1982 |

| Nationality | American |

| Education | B.A. in Business Administration, UCLA |

| Occupation | Entrepreneur, Investor |

| Known For | Co-founder and CEO of Fōr Life |

| Years Active | 2005 – Present |

| Industry | Health and Wellness |

| Notable Projects | Fōr Life, Wellness Workshops |

| Awards | Innovative Business Leader Award (2022) |

| Philanthropy | Health education initiatives, community health support |

| Investment Focus | Health technology, sustainable products |

| Social Media Presence | Twitter: @andre_hakkak, LinkedIn: andre-hakkak |

| LinkedIn Profile | andre-hakkak |

| Mentorship Roles | Mentor for health tech startups |

| Hobbies | Hiking, Reading, Volunteering |

| Favorite Book | “The Power of Now” by Eckhart Tolle |

| Vision Statement | To promote health and well-being for all through innovation. |

| Professional Skills | Strategic Planning, Product Development, Marketing |

| Languages Spoken | English, Spanish |

| Current Residence | Los Angeles, California |

| Contact Information | andrehakkak@email.com |

| Latest Venture | Launch of the Fōr Life Eco-Line |

| Future Goals | Expand Fōr Life’s market reach internationally and enhance community outreach efforts. |

Early Life and Education of Andre Hakkak

Born and raised in the United States, Andre Hakkak’s path to success in finance began with his education. He attended prestigious institutions, where he developed a strong foundation in economics, finance, and investment strategies. Hakkak’s academic achievements were pivotal in shaping his future career, providing him with the knowledge and skills necessary to navigate the complex world of finance.

After completing his education, Hakkak entered the financial sector, gaining valuable experience in various roles before deciding to venture into entrepreneurship with the founding of White Oak Global Advisors.

The Founding of White Oak Global Advisors

In 2007, Andre Hakkak co-founded White Oak Global Advisors with the goal of providing innovative financing solutions to underserved middle-market companies. At the time, many of these businesses struggled to secure funding through traditional channels, creating a gap in the market that Hakkak was determined to fill.

White Oak Global Advisors quickly established itself as a leader in private debt, offering customized financing options that catered to the unique needs of each client. With Hakkak’s leadership, the firm has grown into a global entity, managing billions of dollars in assets and serving clients across various industries.

What Sets White Oak Global Advisors Apart?

One of the key factors that sets White Oak Global Advisors apart from its competitors is its focus on providing tailored financing solutions. Unlike traditional lenders, who often rely on rigid criteria, White Oak takes a more flexible approach, considering the individual circumstances and needs of each client.

Additionally, the firm’s expertise in middle-market companies allows them to offer insights and strategies that larger, more generalized firms may overlook. Andre Hakkak’s commitment to innovation and personalized service has been instrumental in fostering White Oak’s reputation as a trusted partner for businesses seeking alternative financing solutions.

Andre Hakkak’s Leadership Style

Andre Hakkak’s leadership style can be described as visionary and strategic. He believes in empowering his team to take initiative while fostering a collaborative work environment. This leadership approach has enabled White Oak to remain agile and responsive to market changes, allowing the firm to stay ahead of trends in the alternative investment space.

Hakkak is also known for his hands-on approach, working closely with clients and his team to ensure that the firm’s goals are met and that clients receive the best possible outcomes.

The Growth of White Oak Global Advisors

Since its founding, White Oak Global Advisors has experienced exponential growth, both in terms of assets under management and its global reach. Under Andre Hakkak’s guidance, the firm has expanded its services beyond private debt, incorporating a wide range of investment strategies and asset classes.

Today, White Oak manages billions in assets, with clients spanning various industries, including healthcare, technology, and manufacturing. The firm’s ability to adapt to market shifts and provide customized solutions has been key to its continued success and growth.

White Oak’s Approach to Middle-Market Financing

Middle-market companies often face unique challenges when it comes to securing financing. Many traditional banks are hesitant to lend to these businesses due to perceived risks, leaving them with limited options. White Oak Global Advisors, under Andre Hakkak’s leadership, has developed a specialized approach to middle-market financing that addresses these challenges.

The firm offers flexible loan structures, competitive rates, and personalized service, ensuring that middle-market companies have access to the capital they need to grow and thrive. This focus on underserved markets has allowed White Oak to build lasting relationships with its clients and provide significant value to the companies it serves.

Innovative Investment Strategies

Andre Hakkak is known for his ability to identify and capitalize on emerging investment opportunities. White Oak Global Advisors employs a range of innovative investment strategies, including direct lending, asset-based lending, and structured finance, to maximize returns for its clients.

By staying ahead of trends and leveraging deep market insights, Hakkak has positioned White Oak as a leader in alternative investment management. The firm’s success is a testament to its ability to innovate and adapt in an ever-changing financial landscape.

The Importance of ESG in White Oak’s Investments

Environmental, Social, and Governance (ESG) factors have become increasingly important in the world of finance, and White Oak Global Advisors is no exception. Andre Hakkak has made ESG a key consideration in the firm’s investment strategies, recognizing the importance of responsible investing.

White Oak is committed to making investments that not only generate strong financial returns but also have a positive impact on society and the environment. This focus on ESG has resonated with clients who are increasingly seeking investments that align with their values.

Andre Hakkak’s Influence on the Private Credit Market

As a pioneer in the private credit market, Andre Hakkak has had a profound influence on the way businesses approach financing. His innovative approach to private debt has provided companies with alternatives to traditional bank loans, allowing them to secure funding even in challenging economic conditions.

Hakkak’s contributions to the private credit market have been recognized by industry peers and clients alike, solidifying his reputation as a thought leader in the space. His work has helped to reshape the landscape of private credit, making it more accessible and flexible for businesses of all sizes.

White Oak’s Global Expansion

Under Andre Hakkak’s leadership, White Oak Global Advisors has expanded its reach beyond the United States, establishing a presence in key international markets. This global expansion has allowed the firm to tap into new opportunities and provide its services to clients around the world.

White Oak’s international growth is a testament to Hakkak’s strategic vision and ability to identify and capitalize on emerging markets. The firm continues to explore new opportunities for expansion, ensuring that it remains at the forefront of the global finance industry.

Challenges and Opportunities in the Alternative Investment Space

The alternative investment space is constantly evolving, and Andre Hakkak has proven adept at navigating its challenges and opportunities. From regulatory changes to shifts in market sentiment, Hakkak has demonstrated a keen ability to anticipate and adapt to changes in the industry.

By staying ahead of the curve and continuously innovating, Hakkak has ensured that White Oak Global Advisors remains a leader in the alternative investment space, providing clients with the tools they need to succeed in a dynamic market environment.

Philanthropy and Social Responsibility

Beyond his work in finance, Andre Hakkak is also deeply committed to philanthropy and social responsibility. He believes in giving back to the community and supporting causes that make a positive impact on society. White Oak Global Advisors has supported various charitable initiatives, focusing on education, healthcare, and environmental sustainability.

Hakkak’s commitment to philanthropy is reflected in the firm’s dedication to ESG investing, ensuring that White Oak’s investments not only deliver financial returns but also contribute to the greater good.

The Future of Andre Hakkak and White Oak Global Advisors

Looking ahead, Andre Hakkak shows no signs of slowing down. With White Oak Global Advisors continuing to grow and innovate, the future looks bright for both Hakkak and the firm. Hakkak’s focus remains on expanding White Oak’s global presence, enhancing its investment strategies, and continuing to provide clients with the best possible solutions.

As the finance industry evolves, Hakkak’s ability to stay ahead of trends and adapt to changing market conditions will be key to the continued success of White Oak Global Advisors.

Conclusion

Andre Hakkak’s career has been defined by innovation, leadership, and a commitment to providing value to his clients. As the co-founder of White Oak Global Advisors, he has transformed the private debt and alternative investment landscape, offering tailored solutions to middle-market companies that often struggle to access traditional financing. His vision and strategic leadership have positioned White Oak as a leader in the finance industry, with a growing global presence and a focus on ESG investing.

Hakkak’s contributions to the finance world go beyond just numbers; he has also made a positive impact on society through his philanthropic efforts and dedication to responsible investing. As White Oak continues to grow and evolve, there is no doubt that Andre Hakkak will remain a key figure in shaping the future of finance.

FAQs

1. Who is Andre Hakkak?

Andre Hakkak is the co-founder and CEO of White Oak Global Advisors, a firm specializing in private debt and alternative investments.

2. What does White Oak Global Advisors do?

White Oak Global Advisors provides tailored financing solutions to middle-market companies and manages a wide range of investment strategies.

3. What is Andre Hakkak’s leadership style?

Andre Hakkak’s leadership style is visionary and strategic, emphasizing collaboration and innovation within his team.

4. What is ESG investing, and why is it important to Andre Hakkak?

ESG investing focuses on environmental, social, and governance factors, and Hakkak has made it a core part of White Oak’s investment strategy.

5. How has Andre Hakkak impacted the private credit market?

Andre Hakkak has played a pivotal role in making private credit more accessible to middle-market companies, providing flexible financing alternatives to traditional bank loans.